Types of Churn: Understand the difference

Zoox Smart Data - 26 de November de 2021.

Zoox Smart Data - 26 de November de 2021.

Voluntary Churn, Involuntary Churn, Revenue Churn and many other types are covered in this article so that you are no longer in doubt and know which are the most valuable for the growth of your company.

We have already explained in our other article that Churn is a fundamental metric for entrepreneurs in various verticals.

If you haven't had a chance to read it yet, it's worth a click to better understand the more global concept of Churn - and also to take note of the strategic tips we've given to lower Churn in your company.

But in this article, we'll focus on understanding the different types of Churn that can serve as an evaluation metric and increase your analytical perspective of your business.

After all, the more we know about our target audience, the better we define our strategies. As in many board games, strategy rules. It is defined by precise calculations and helps us figure out which pawn we should bet on to get closer and closer to victory.

As you read on, you will better understand how to identify:

- Voluntary Churn

- Involuntary Churn

- Logo Churn

- Revenue Churn (Gross Churn)

- Early churn

- Negative Churn

Voluntary Churn

This is the most basic one. Voluntary Churn happens quite often in the market. And we have already talked about it in the article we mentioned before.

"Voluntary" is because it speaks of cancellations, contract terminations made by the client's own will, spontaneously.

However, the fact that it is common 'for a customer to terminate a business relationship because he/she wants to' does not mean that you do not have to investigate the reasons why.

If there is a very significant increase in this churn rate, get closer to your customers. Invest in surveys or NPS at the time of that cancellation.

Possible reasons for a voluntary cancellation could be:

- financial issues

- dissatisfaction with the product/service - it is always important to try to understand why

- lack of brand support

- little personalization in the attendance/product/service

- better proposal from the competition

- after a while of usage, the client didn't see the value

among others.

Regardless of the reason, it may hide a key turning point for your business, be it in your service/product, logistics, employee training, etc.

With the results in hand, your team can act more strategically to solve these points as quickly as possible.

Its calculation is simple:

Involuntary Churn

Both Voluntary and Involuntary Churn are calculated in the same way, the difference between them is in the reason that caused the Churn to happen.

In the case of Involuntary Churn, the company needs to disconnect from the customer for a compelling reason. For example:

- Fraud was found

- Problems with payments

- Failure in the transaction - here it is worth understanding whether, there being an intermediary company,

some problem occurred in the system - Absence or impossibility of company-client contact at the time of contract renewal

among others...

In other words, Churn occurs without the "will" of the client. To prevent this from happening, your business can adopt systems that work with automation models when it is necessary to make a collection, warn about payment errors or the proximity of the end of the contract.

Logo Churn

We put this one here so that you could be aware of the nomenclatures and not look silly in a meeting.

Logo Churn is just another name for this cancellations metric, i.e. it also corresponds to the "classic" Churn

The calculation is done in the same way as above.

Revenue Churn (Gross Churn)

These names refer to a type of Churn that does not speak about the loss of the customer necessarily, but about the loss of revenue from the customer.

It does not mean a total cancellation or severance of the customer's commercial relationship with your company, but a reduction in the payment that this client makes to your business.

In other words, it is a downgrade. It happens when, for example, a client who had a contract with a more complete package, subscribes to a basic or simpler package of services/products.

This, of course, is not the worst Churn of all, but it directly impacts the company's revenue, since it causes a reduction in billing.

In this case, it is important to realize that there is no dissatisfaction from the customer, since he/she only chose to reduce the payment, but did not break the commercial link.

However, there was a reduction in the amount invested, and it is important that your company gets closer to this client, understands this change, and, who knows, offers an interesting counterproposal.

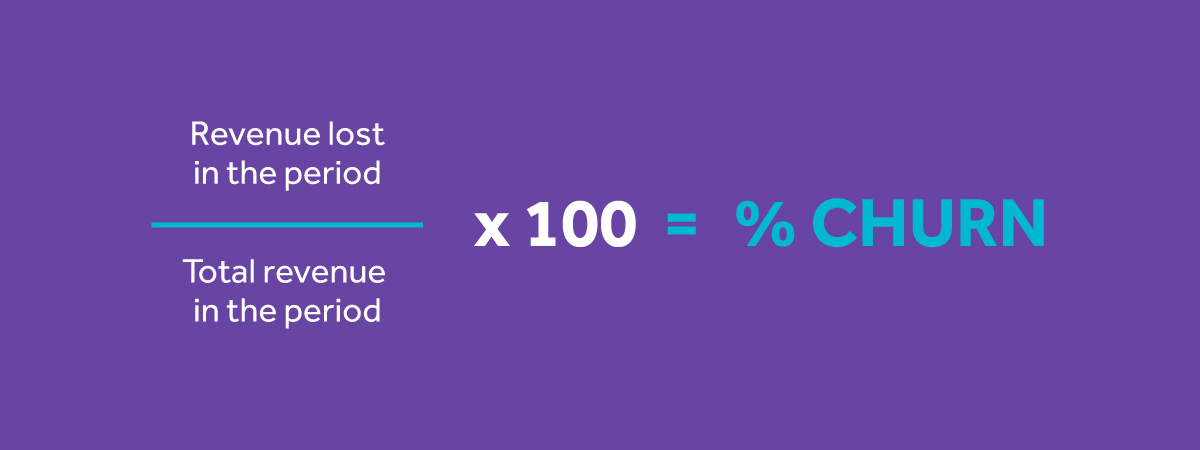

To make this calculation, it is simple.

Early churn

This is a Churn considered premature because it happens a few days after the contract has been signed or the sale has been made.

To reduce this rate, it is important to have a Customer Success team that follows up with this customer and offers a great experience from the beginning.

Long waits by the customer to receive a product or to implement a solution can cause this type of Churn, as well as lack of contact in the first moments after the purchase.

Negative Churn

Negative churn is most of the time good news. When this index appears negative, it means that revenue has increased, even with cancellations.

In other words, active customers have increased the amount of money they invest in your product, service, started buying more expensive packages, or created more subscriptions.

However, although the news is positive, you have to be careful. This rate does not mean that it is no longer necessary to track cancellations, their volume, and their causes.

In fact, the follow-up should be continuous, not only to understand the negative factors (which led to the cancellations), but also to understand the positive ones (which indicate the reasons why customers have become loyal to your brand).

The math is identical to that of Revenue Churn, but its result is negative.

In conclusion, all Churn calculations are important and your strategy should include periodic monitoring of these indexes to avoid cash surprises and unexpected changes of direction.

Thinking of mitigating the increase in this rate, we have separated some solutions in another article for you to understand how your company can act to control Churn in the best way.

If your company wants to know more about your client, work on a better experience and uncover the path to new revenue, talk to a Zoox consultant - our Big Data and Connectivity solutions may be what's missing for your business to go even further.

.jpg)

Comments