Risk Analysis in Insurance Market: The Value of Hyper-segmented Pricing

Zoox Smart Data - 29 de July de 2022.

Zoox Smart Data - 29 de July de 2022.

Risk' is a word that brings with it adrenaline and butterflies in the stomach. After all, taking risks requires courage - and why not intelligence and knowledge? Whether it is the risk of failure, or of success, or any other risk, it means that caution and a dose of protection are essential, so that the unforeseen do not become a nightmare.

And this is how not only those seeking insurance think, but also companies and big insurance leaders in their strategies. Managing a company requires making important decisions on a daily basis. In this context, the value of a well-done risk analysis can be seen.

If you want to understand more about the importance of Risk Analysis for Insurance Companies, the technologies that help to perform an accurate assessment, and the value of a segmented pricing strategy,keep reading.

Data-Driven Risk Analysis X Guesswork

To recap, when we talk about risk, we talk about events with uncertain probability, with possible impact on project results. And it is essential to stress here that a risk can be both a threat and an opportunity.

And to prevent bad risks and take advantage of good risks, data are the best allies. Depending on the activity and the objectives, the type of risk will vary, as will the variables and methodologies to be taken into consideration when conducting a preliminary risk analysis.

In this regard, predictive models, statistical analysis, artificial intelligence, and machine learning are technologies that do not try to predict the future, or will rely on intuition and guesswork, but rather evaluate diverse sources of historical data to understand what the most likely future scenario would be - helping companies and leaders make the best decisions to increase revenues and avoid future losses.

In a car insurance company, for example, providing a quotation with accurate data can be the key to fraud prevention.

If we think hypothetically about offering a quote to Richard, a 30-year-old engineer who bought a used car and is looking for insurance, it is essential to know his professional occupation, demographic data, accident history, data from other insurers of which he may have been a customer, geo-referenced, social, consumer, and digital data, among others.

If Richard also works as an app driver and his car is one of the most targeted according to theft records in the city where he lives, the quote will be one. Now, if Richard works remotely and uses the car to visit his family in a neighborhood with few police occurrences, the insurance price changes, you see?

Therefore, data-driven risk analysis helps to better understand variable costs, viability, main threats and opportunities, and avoids future losses to insurers, since the Insurtech will charge an amount proportional to the risk offered by the contractor.

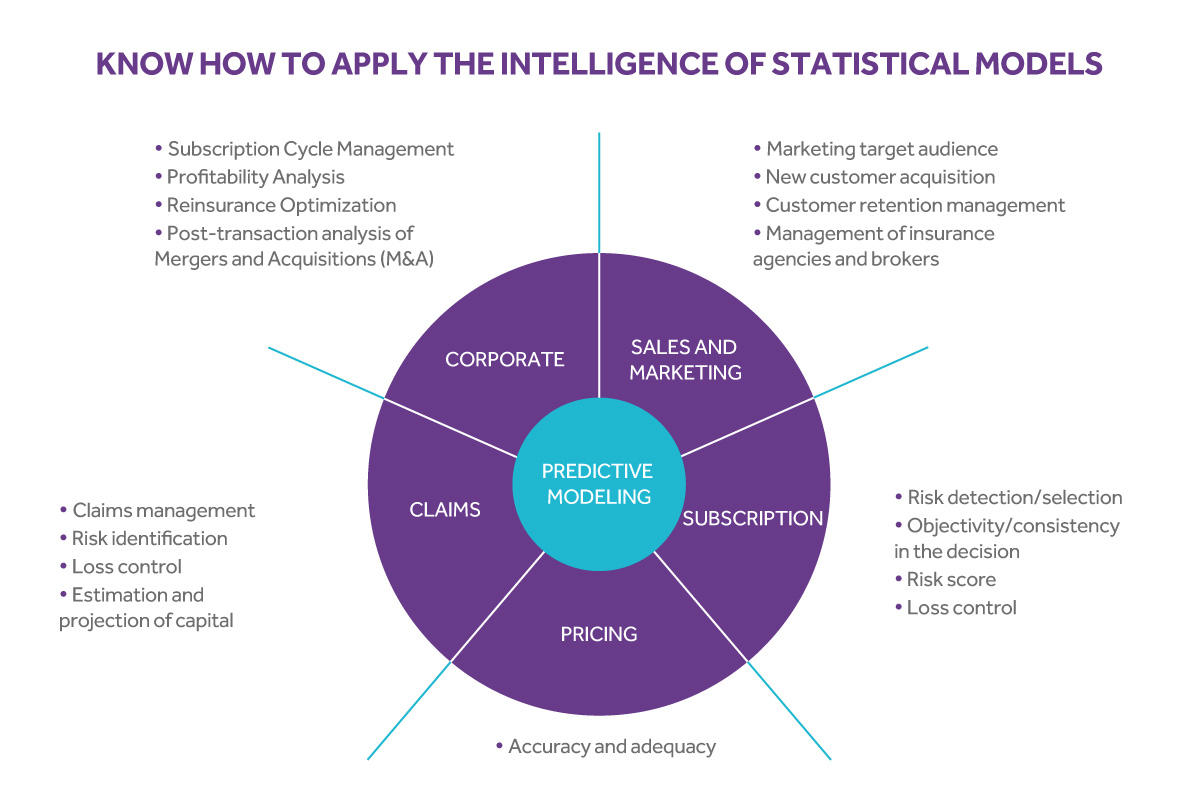

Observe in the chart below how Statistical Models can be applicable to several areas within an Insurance Company Hyper-segmented Pricing

Hyper-segmented Pricing

With the help of technologies such as Predictive Analytics and Artificial Intelligence, Hyper-segmented Pricing becomes possible. Since patterns in the data in past cases are identified, it is easier to build solutions that predict what may happen in future situations.

Businesses are able to grow more safely, minimizing risks when technology helps us turn what is uncertain into predictable.

According to McKinsey, experts estimate that there will be up to 1 trillion connected devices by 2025. The avalanche of new data created by these devices will enable operators to understand their customers more deeply, resulting in new product categories, more personalized pricing, and increasingly real-time service delivery.

Speaking of digital transformation, the insurance market is already moving towards smart product recommendations as well. The consumer benefits, as he or she receives offers more in line with his or her needs.

What is the main result of a Quality Risk Analysis?

Risk analysis can offer numerous benefits, especially if it is accompanied by data-driven management, which integrates information and allows access by various internal areas. The results are many, such as fraud prevention, investment targeting, and others:

- Improves customer experience, reducing attrition

- Improves processes in several areas (operations, performance, financial, communication)

- Supports security, data protection and privacy frameworks

- Helps leaders to make insightful decisions

- Increases ROI

- Mitigates future risks and problems

- Balances chargeback, response time, and approval rates

If the information in this article has been helpful in deepening your understanding of risk analysis, check out our Data Science & Analytics solution, Zoox Eye. The platform brings together data intelligence data, asset engineering, geoanalytics, machine learning, BI, and AI - with over 150 native connections capable of combining customer data with market analysis and more than 200 variables.

Zoox offers intelligent, automated, statistical models with a high level of value and assertiveness. For risk of theft and burglary, for example, Zoox's model improves assertiveness by up to 20% in lower and higher risk segments, with proven results and direct impact on EBITDA by 13%. Talk to one of our experts and schedule a demo.

Comments