Black Friday Fraud Prevention: how to manage risks in Retail?

Zoox Smart Data - 7 de October de 2022.

Zoox Smart Data - 7 de October de 2022.

The more digital our lives become, the more we are exposed to fraud not only as consumers, but as companies. Preventing losses is a challenge that demands investment in many resources - and technology can and must be one of them.

Privacy, data protection, fraud prevention, and risk management need to be part of the strategy of every company or executive who wants to thrive in the digital environment of sales, payments, and services. And on one of the most coveted dates for the retail market - Black Friday - this concern has to be doubled.

After all, 1 fraud attempt occurs every 8 seconds, according to a survey by Serasa Experian. Just as there are new and more sophisticated fraudulent attacks, there are also many new payment methods, user authentication, and technologies that we can count on to combat these digital crimes and grow the competitive edge over competitors.

Keep reading to learn more about the concept of fraud and possible actions against this crime not only during Black Friday, but all year round.

What is fraud prevention?

Before talking about prevention, let's go to the definition of a fraud scheme. Here in this article, we understand fraud as

an intentional unlawful or deceptive act to obtain undue advantage and thereby harm others.

Some examples of fraud schemes are, for example, document forgery, contract tampering, embezzlement, and registration of unproven transactions.

Now, if we talk about fighting fraud, this work is characterized by planning, which involves administrative and operational actions and monitoring to curb losses related to fraud or attempted fraud.

In this sense, it is important to emphasize that the losses are not always financial, but can be judicial, concerning the image and reputation of the company both to society and internally, and also losses of sensitive and confidential data.

It is worth mentioning that one of the main causes for the occurrence of fraud in Retail is the lack of transparency. Whether in the processes, information security frameworks, culture or risk management, all employees, regardless of area, need to receive training and guidance aimed at fighting fraud.

The Fraud Triangle

Since we know that, in order to prevent, it is necessary to know the enemy, we brought here the Fraud Triangle - theory presented in 1953 by the sociologist Donald Cressey - which explains the 3 pillars that make up the motivation for fraudulent behavior.

- Pressure

Pressure usually comes from financial problems. These are situations in which an individual has his or her standard of living and financial stability affected. The person may suffer from the fear of losing his or her job, for example, or be experiencing severe unemployment, and this can lead him or her to commit online crimes.

- Opportunity

But not only pressure can trigger fraudulent behavior. An opportunity can be identified in an unassuming way by an individual who is surfing the Internet and finds flaws in systems or internal controls.

At this moment an emotional trigger may act in the individual's mind for the chance to commit illicit acts for his or her own benefit with the possibility of not being caught.

- Rationalization

The final pillar of the fraud triangle is a mental process of self-conviction that the financial crime or irregularity committed can be justified by personal needs. That is, the individual would be above ethics, law, or corporate norms.

What are the steps to fraud prevention?

It is not enough to write an ethics manual and hire a team of IT and risk analysts on the eve of Black Friday.

Fraud prevention is an activity that is not solved by "off-the-shelf products" and cannot be a static process. This is because just as human error is the main cause of enabling online crime, fraudsters are also human and many of them understand a lot about your company and your product and are constantly looking for opportunities.

As you may have realized by now, there is no "end" to the fraud prevention strategy - "leave the analytics model running and that's it". Learning is as constant as new types of fraud. However, some little rules don't change - even though application scenarios and decision-making do.

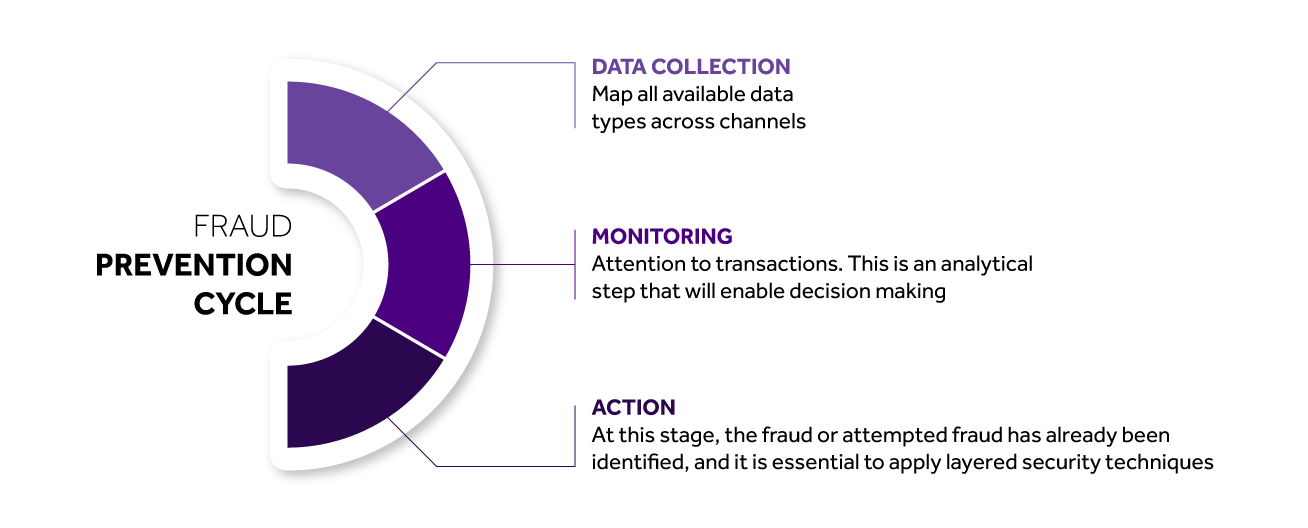

Let's get to know the Fraud Prevention Cycle together. This step-by-step is critical for you to not only start a risk management strategy, but also deal with fraud-related emergencies.

1. Data Collection

This is the time to identify where the problem is coming from. And only data can give you the answer. Collecting information from all your channels is fundamental to solve problems, not only in an emergency way, but also in the future, so that the technology team can reinforce digital security.

Typically, the fraud scheme occurs at the points of contact between your internal system and the consumer. Aggregate this information with the help of good Data Science and Data Intelligence software and move on to the next step.

2. Monitoring

With the mapping of the entire operation and records of the inbound and outbound information ports, now is the time to process this data - manually and automatically - to do fraud management.

Now is the time when the team needs to come together to identify fraudulent behavior, monitor processes that have already occurred, but also those occuring in real time. This makes it easier to curb the fraudster.

The decision making comes from the breaches and incidents found by the team during this monitoring.

3. Action

The third and "last" stage of the cycle involves the adoption of security measures based on what was found during the monitoring. We put "last" in quotes because it is important for you to understand that this is a cycle, so when working with layered security techniques to stop the fraudster, it is necessary that the scanning of the system continues until there are no more weak points that can generate more losses.

This step can also come into play when the monitoring actions were not enough. It is as if it were impossible to prevent or better identify the fraudster's action, and it is necessary that your team goes to "war" with him.

The moment is not only for the technology team to take action. It is important to map other initiatives such as training with employees, for example, related to ethics, care, punishments and policies to prevent money laundering, fraud and other online crimes.

Periodic audits and manual or automatic review of financial transactions are also fundamental, in addition to redoubling attention to the relationship with suppliers and customers who may be suspicious. But we will talk about solutions further ahead.

However, we emphasize that you must be very careful with everything involving the customer - he or she is the reason for your company. In these manual or model-based checks and investigations, you have to be very careful with false positives. After all, can you imagine the risk of exposing your customer to an unfair accusation?

Data Science: your great ally in the fight against fraud

An effective fraud prevention strategy has, at its core, analytical intelligence and Data Science. This is because your Retail can learn and gain a lot from continuous and intelligent monitoring through sophisticated decision models.

The truth is that every company that does business in the digital environment will lose something through fraud. It is not possible to prevent 100% of fraudulent attitudes. But it is possible to learn from them to strengthen the security of your products and systems to gain more than you lose.

For this reason, we have thought up a short list of actions that your company can take to reduce the incidence of fraud with a little help from technology.

Have a transparent organizational culture

Companies committed to fraud prevention have internal measures in place to clarify the behavior expected from employees. It is imperative to ensure that all employees have a company code of ethics, as well as a code of behavior - and we recommend that this is a top-down move.

Information security management needs to be reflected in the day-to-day actions of employees to reduce incidents. Therefore, invest in training, integration, lectures, awards, everything that can engage your team to be above average in digital security.

A corporate governance plan, with established and clear processes for the whole team can be a smart way out. Here at Zoox, for example, we work and develop products and solutions based on the Privacy by Design framework.

Monitor constantly

Knowing how information circulates in your company is fundamental to monitor if the flows are correct and secure. Map the integration between sectors, data storage, and process automation. It can also be interesting to carry out periodic audits to reduce biased evaluations and fraud, as well as to hire new professionals who can be more closely tied to this monitoring.

Of course, it is also necessary to think about punishments, however unpleasant this may be. Punishments are created to curb fraud and can range from fines, to lawsuits, to dismissals, to loss of position.

Seek out partners and state-of-the-art technology

Technology comes into play to do the automated work that could not be done as efficiently by people. In this sense, a simpler step is to have up-to-date antivirus and anti-fraud systems.

However, there is a second, more complex step that includes contracting software and creating analytical models to recognize flaws in your systems and products, as well as periodically monitoring transactions, the competition, defining customer and supplier risk scores, and much more.

After all, cases of unauthorized use of personal id and corporate ID numbers for illicit operations, such as loans, financing, and even purchases in e-commerce environments are not uncommon. In the case of turbulent periods such as Black Friday, this work intensifies, and, depending on the expertise of your team, it may be more interesting to outsource this service and rely on partners with more experience.

Through secure and scalable APIs and the validation and interpretation of past and current customer information using Artificial Intelligence, Analytics, Machine Learning and Data Science, your company can be safer to sell more and better this Black Friday.

Like it or not, fraudsters are creative, and your anti-fraud protection should be too! Get to know our Data Science & Analytics platform, Zoox Eye, and see what we can do for your company to take off - safely - on Black Friday.

Talk to a specialist . Fill out the form and we will contact you.

Comments